Gross Margin

Everything You Need to Know about Gross Margin:

What is Gross Margin?

• In economics, gross margin is the difference between the production costs (excluding payroll, taxation, interest payments, and overhead) and sales revenue. Gross margin, as a result of this ratio, can be defined as the amount of contribution to a business, after paying for all direct fixed and variable costs.

• Gross margin is simply all revenue obtained by a company minus the cost of the goods sold, divided by the revenue. When expressed in absolute terms gross margin is equal to the company’s net sales minus the cost of the goods sold plus the annual sales return. Furthermore, gross margin may also be expressed as a ratio of gross profit to the cost of goods sold, typically in the form of a percentage.

• The cost of sales, used in the gross margin calculation, will include all variable costs and fixed costs of the business operation. These costs must be linked directly to the sale of the company’s product; material costs, labor, shipping costs and supplier profits are all accounted for in the cost of sales. That being said, cost of sales does not include any indirect fixed costs, such as office expenses, administrative costs, rent etc.

• As a result of these variables, a higher gross margin (for a manufacturing company) will typically reflect a greater efficiency in regards to turning raw materials into income. For a retailer, a higher gross margin reflects the company’s markup over wholesale. A larger gross margin is generally considered ideal for the majority of business entities.

How is Gross Margin used to Measure Profits?

• A retailer may measure their profit by utilizing two analytical methods: markup and margin. Both methods will give a description of gross profit; the markup expresses profit as a percentage of the retailer’s cost per product, while the margin expresses profit as a percentage of the retailer’s sales price for the product.

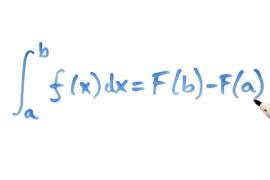

• The equation used to calculate the markup or the monetary value of gross margin is the following: sales-cost of goods sold.