Black Scholes Explained

Black Scholes Defined:

• Black Scholes is a mathematical model, used predominantly in finance, which contains a specific derivative investment. From analyzing the Black Scholes model, an individual can deduce a formula, which yields the pricing model of European-style options. The creation of the formula led to a boom in options trading, the formation of the Chicago Board Options Exchange and a revolution in regards to how traders observe and interact with options.

History of the Black Scholes Model:

• The Black Scholes Model was first formulated by Fischer Black and Myron Scholes in their 1973 dissertation, titled “The Pricing of Options and Corporate Liabilities.” The two economists derived a partial differential equation, known as the Black-Scholes equation, which regulates the price of an option contract over time. The basic premise behind the formula was to create a perfect hedge for the option by buying and selling underlings assets in a way that eliminated risk.

Black Scholes as a Hedge:

• The hedge, which is called the delta hedging process, is the basis for more complicated hedging strategies now used by institutional traders, investment banks and hedge managers. The Delta Hedge implied only one accurate price for an option contract; as a result of this assumption, the Black Scholes Model was incorporated to accurately assess and mitigate risks for the buying and selling of option contracts.

What does the Black Scholes model do?

The Black Scholes model is used to estimate prices of option contracts; a number of empirical tests have shown that the Black Scholes pricing model is fairly close to the observed prices of option contracts. The Black Scholes model, for a particular stock, will utilize the following assumptions:

• Arbitrage opportunities do not exist; there is now to obtain a profit without risk• It is feasible to borrow and lend cash at a constant risk-free interest rate• It is possible to engage in the buying or selling of any amount of stock• The underlying security will not pay a dividend• The transactions associated will not incur any fees or added costs

From these basic assumptions, the Black Scholes model states that a hedge position is possible if the investor takes a long position in the stock and a short position in the option.

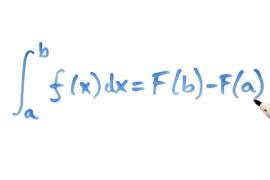

The Black Scholes Formula

• The Black Scholes Model is derived from the Black Scholes formula, which calculates the price of European put and call option. The Black Scholes Formula is typically employed as a useful approximation of price expectations. The user of the model; however, must understand the formula’s limitations—blindly following the components of the model will expose the user to an assortment of unexpected risks.