2 Questions about Equity

What is Equity?

The term ‘equity’ refers to interest or the residual claim of a class of investors in assets once all liabilities have been fulfilled.

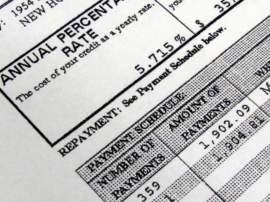

Equity can be described in the case of home ownership. When an individual purchases a home, they typically finance their purchase with a mortgage. The mortgage, which in essence is a loan offered by a bank or a similar lending institution, represents the percentage ownership of the lender. As the mortgage is paid off, the individual assumes a coordinating percentage ownership of the home. This percentage ownership is referred to as equity. In an accounting context, shareholders’ equity represents the remaining interest in the underlying assets of a company, which is spread among individual shareholders of either common or preferred stock.

In regards to business ownership, an owner (at the starting point of their business operation) will finance the model through financing. This financing creates a liability on the business in the form of capital as the business is a separate legal entity from its ownership. Once the liabilities have been accounted for, the remaining positive balance is regarded as the owner’s interest or equity in the business.

Understanding equity is crucial when evaluating and comprehending the liquidation process of bankruptcy. During its first stage, all of the secured creditors are paid against the proceeds obtained from the assets present. Subsequently, a series of creditors (which are ranked in priority sequence) have the following claim on the residual proceeds. Ownership equity is the last residual claim against the present assets, which are paid only after all of the other creditors are satisfied. In cases where even the creditors could not be reimbursed, nothing is left over to satisfy the owners’ equity. As a result, the owners’ equity is reduced to 0.

What are Equity Investments?

An equity investment refers to the process of buying and holding shares of stocks listed on a market by corporations or individual firms that distribute dividends and capital gains.

An equity investment may also refer to the acquisition of ownership (equity) in a private or Startup Company. When an investment is made in such novel companies, it is referred to as a venture capital investment and is generally regarded as a higher risk investment strategy.

The equities obtained by private investors are often held by mutual funds or other investment companies, many of which are quoted on major exchanges or publications. Such investment strategies enable investors to obtain a mitigated risk through the diversification of various securities. Additionally, such investment companies are run and handled by professional fund managers. An alternative equity investment is employed by private investors and pension funds, where the equities are held directly.

When the owners of equity take the form of shareholders, the interest is typically called shareholders’ equity. In the stock market, the market price per share is not directly related to the equity per share as calculated and offered in accounting statements. Therefore, stock valuations, are often higher and are based on alternative considerations that relate to the business’ operating cash flow, future prospects and profits.

NEXT: All You Need To Know About A Hedge Fund